Article Highlights

- Home never rented

- Home rented for fewer than 15 days

- Home rented for at least 15 days with minor personal use

- Home rented for at least 15 days with major personal use

- Vacation home sales

- Vacation home rules

Vacation Home: How is the Rental Income Taxed?

If you have a second home in a resort area, or if you have been considering acquiring a second home or vacation home, you may have questions about how rental income is taxed for a part-time vacation-home rental. The applicable rental rules include some interesting twists that you should know about before you begin renting. Although some individuals prefer to never rent out their residental homes as vacation homes, others find such rentals to be a helpful way of covering the cost of the home.

For a home that is rented out part-time, one of three rules must be considered, based on the length of the rental:

Rule #1: Home Rented For Fewer Than 15 Days

If a property is rented out for fewer than 15 days in a year, the property is treated as if it were not rented out at all: The rental income is tax-free, and the interest and taxes paid on the home are still deductible. In this situation, however, any directly related rental expenses (such as agent fees, utilities, and cleaning charges) are not deductible. This rule can allow for significant tax-free income, particularly when a home is rented as a filming location.

Rule #2: Home Rented For At Least 15 Days With Minor Personal Use

In this scenario, the residential home is rented for at least 15 days, and the owners’ personal use of the home does not exceed the greater of 15 days or 10% of the rental time. The home’s use is then allocated as both a rental home and a second home. For example, if a home is used 5% of the time for personal use, then 5% of the interest and taxes on that home are treated as home interest and taxes; these costs can be deducted as itemized deductions. The other 95% of the interest and taxes, as well as 95% of the insurance, utilities, and allowable depreciation, count as rental expenses (in addition to 100% of the direct rental expenses). The combined expenses for all rental activities are deductible as a tax loss. However, this amount is limited to $25,000 per year for a taxpayer with an adjusted gross income of $100,000 or less and is ratably phased out between $100,000 and $150,000. Thus, if a taxpayer’s income exceeds $150,000, the rental-expense tax loss cannot be deducted; it is carried forward until the home is sold or until gains from other passive activities can be used to offset the loss.

Rule #3: Home Rented For At Least 15 Days With Major Personal Use

In this scenario, a residential home is rented for at least 15 days, but the owner’s personal use exceeds the greater of 14 days or 10% of the rental time. With such major personal use, no rental-related tax loss is allowed. For example, consider a home that has personal use 20% of the time and is a rental for the remaining 80%. The rental income is first reduced by 80% of the combined taxes and interest. If the owner still makes a profit after deducting the interest and taxes, then direct rental expenses and certain other expenses (such as the rental-prorated portion of the utilities, insurance, and repairs) are deducted, up to the amount of the remaining income. If there is still a profit, the owner can take a depreciation deduction, but this is also limited to the remaining profit. As a result, no loss is allowed, and any remaining profit is taxable. The interest and taxes from personal use (20% in this example) are deducted as itemized deductions, which are subject to normal interest and tax limitations.

Vacation Home Sales

A vacation home rental is considered a personal-use property. Gains from the sales of such properties are taxable, and losses are generally not deductible.

Unlike primary homes, second homes do not qualify for the home-gain exclusion. Any gain from a second home is taxable unless it served as the taxpayer’s primary residence for two of the five years immediately preceding the sale and was not rented during those two years. In the latter scenario, the taxpayer does qualify for the home-gain exclusion, provided that he or she has not used that exclusion for another property in the prior two years. As a result, by the home-gain exclusion can offset an amount of gain that exceeds the depreciation previously claimed on the home; this amount is limited to $250,000 for an individual or $500,000 for a married couple filing jointly (if the spouse also qualifies).

There are complicated tax rules related to the home-gain exclusion for homes that are acquired in a tax-deferred exchange or converted from rentals to primary residences. Homeowners may require careful planning to utilize the home-gain exclusion in such cases.

As an additional note, when a property is rented for short-term stays or when significant personal services (such as maid services) are provided to guests, the taxpayer likely will be considered a business operator rather than just an individual who is renting a home. If so, the reporting requirements will differ from those outlined above.

Vacation Home Rules

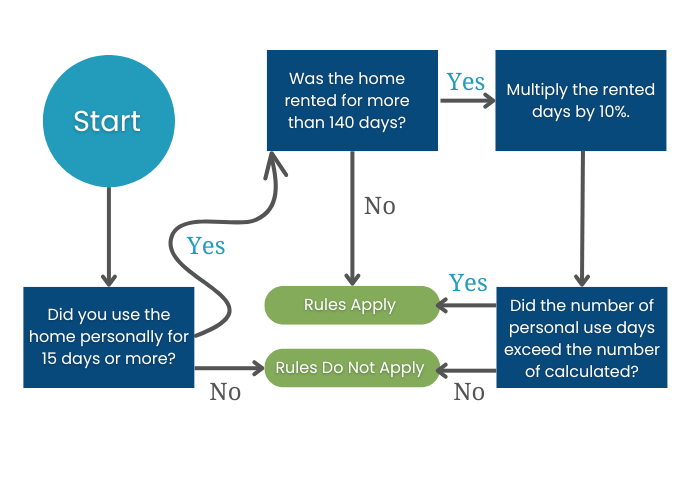

Expenses incurred by you for maintaining vacation properties and personal residences that you rent have a unique set of rules for tax purposes. Even if you might not otherwise consider the property as a vacation home, these rules may still apply.

Before you make this determination, review this illustration.

Q: Did you use your home for more than 15 days in the reporting year?

- If not, the vacation rules do not apply.

- If yes...

Q: Was the home rented for more than 140 days?

- If no, then vacation rules apply.

- If yes, multiply the rented days by 10%. If the number of personal use days exceeds 10% of the rented days, vacation rules apply.

If you let someone stay at your property for less than fair market value, or for free, the IRS considers this to be a personal use by you. If that is true, taking business deductions on the property is not appropriate.

Getting Tax Help for Your Vacation Home Rental

As with all tax rules, there are certain exceptions to be aware of. Please call this office to discuss your situation in detail.