An eCommerce business has the potential to make an individual extremely wealthy while also allowing him or her to start a company from the comfort of home and with very little capital.

The Do-It-Yourself (DIY) appeal of this online selling approach has caused an exponential increase in the number of eCommerce businesses worldwide. Yet eCommerce businesses also have an extremely high failure rate; most experts agree that the percentage of eCommerce businesses that fail is around 80%.

One of the biggest reasons that eCommerce businesses fail is that they are created without a plan. Planning, when done right, takes inventory of current processes and products, creates actionable responses to future problems, and allows the company to grow as slowly — or quickly — as the owner desires.

Strategic planning is one of the biggest assets that Certified Public Accountants (CPAs) can bring to an eCommerce business. From fundamental accounting and taxes, to knowing when to setup an LLC or a corporation, CPAs are trained to help businesses grow.

Having a CPA help with strategy is an essential component to a successful eCommerce business.

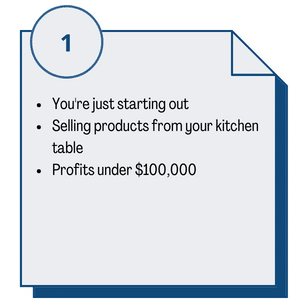

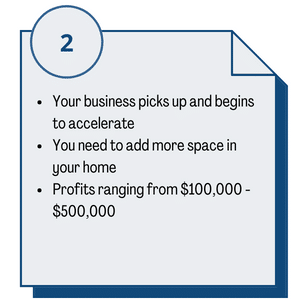

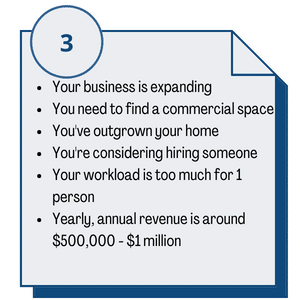

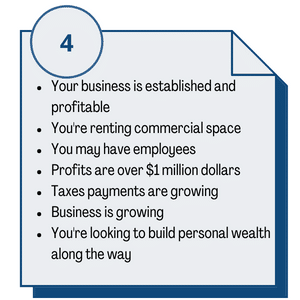

Stages of eCommerce Business

Click on the phase of your eCommerce business (below) to learn about the benefits of having a CPA on your team (preferably from day one), and the related accounting and tax needs of each one, based on the average annual sales (roughly) of your eCommerce business.