Rental activities generally fall into the category of “passive” activities. This means that rental losses you incur can be deducted only against passive income and not against nonpassive income, such as wages or investment income.

If you cannot use losses in a particular year because of the rules, the losses are carried forward indefinitely to future tax years in which your passive activities generate enough income to absorb the losses.

However, if you “actively participate” in the residential rental activity, you may be able to deduct a loss of up to $25,000 in a tax year against nonpassive income. You actively participate in the rental activity if you make important management decisions, such as approving new tenants, deciding on rental terms, and approving capital expenditures. You also can show active participation by arranging for others to provide services. You need not have regular, continuous, and substantial involvement with the property.

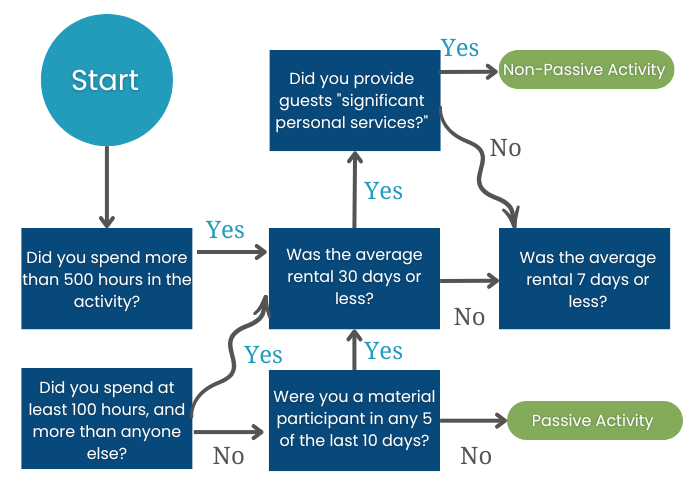

The following flow chart can be used in most cases to determine whether your Airbnb short-term rental is a passive activity.

Q: Did you spend more than 500 hours during the year working on your rental activities?

- If no, did you spend at least 100 hours during the year, and did you work more hours than anyone else?

- If not, did you materially participate in any 5 of the last 10 years? If Not, this was a passive activity.

- If yes, you spent 500 or more hours working on the rental property, or at least 100 hours and spent more hours than anyone else, ask yourself:

-

Q: Was the average rental 30 days in duration or less?

- If yes, did you provide “significant services” to guests? If so, your property may be treated as a non-passive activity.

- If no, was the average rental seven days or less? If it was, your property was a non-passive activity. If it was not, it should be considered passive.

-

Activities that qualify under the 500-hour and 100-hour rules include things like

- Showing the property to potential renters;

- Reviewing leases and contracts, as well as;

- Tasks such as providing bookkeeping and purchasing, and;

- Hours spent scheduling and managing vendors and employees, as well as certain service activities you may perform for guests of your property

Contact us today to learn more about your rental property(s) and how we can help.