In 2020, the IRS reintroduced Form 1099-NEC to report non-employee compensation on a separate form. Box 7 of the 1099-MISC was replaced and is now used to report direct sales of $5,000 and more. For the 2022 tax year, the FATCA Filing Requirement checkbox can now be found on Box 13. Boxes 13-17 from the 2021 version of the form have been renumbered as 14-18 to accommodate this change.

What are the changes?

The IRS has made a few updates to Form 1099-MISC, which will be effective for the 2022 tax year. Box 13 is now a checkbox used to report the Foreign Account Tax Compliance Act (FATCA) filing requirement. As a result of this update, the original boxes 13-17 have been renumbered.

- Box 13 is used to indicate the Foreign Account Tax Compliance Act (FATCA) filing requirement.

- Box 14 is used to report the excess gold parachute payments.

- Box 15 is used to report the payment under NQDC plans.

- Box 16 is used to report the state-withheld taxes.

- Box 17 is used to report the payer's state number.

- Box 18 is used to report the state income.

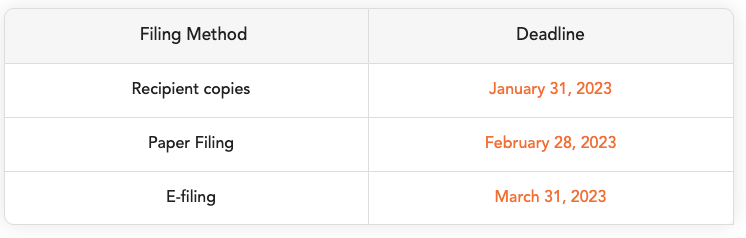

What is the deadline?

The IRS requires payers to issue a copy of Form 1099-MISC to the recipient by the end of January 31st. The deadline to submit paper copies to the IRS is on February 28th, and the e-filing deadline for Form 1099-MISC falls on March 31st.

The Form 1099-MISC deadlines for the 2022 tax year are as follows:

e-Filing Benefits

The IRS prefers e-filing to paper filing because it is a simpler method and tracking electronic copies of forms is more efficient than tracking paper copies.

Don’t leave your taxes to chance. Give us a call about preparing your taxes.