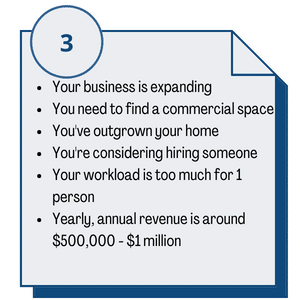

Remember that business plan from Phase 1?

This is the perfect phase in your growing eCommerce business to assess cash-flow forecasts to plan for your business goals as you move into becoming a $1M+ online seller. This is where you show your current financial state, which helps with securing funding (if needed) and getting that commercial space you have your eye on — because your house simply cannot take another delivery.

- After you’ve acquired commercial space, you’re likely looking to hire additional people, if you haven’t already staffed up running out of your home.

- Have you considered employment/ contractor agreements?

- Benefits to keep talent motivated and working with your business?

- Additional insurance needs?

These are all questions as you staff up from 2-10+ people helping you run your growing eCommerce business. There’s no better person than your CPA to advise you on how to go about setting up payroll — in a way that will allow you to expand without cutting corners or neglecting to follow employer regulations.

Tax strategy is another vital ongoing advisory service that your CPA can help with, as your profits are increasing rapidly.

A CPA also knows what kind of deductions you are able to take as a small business owner and is able to maximize those deductions for you, minimizing the overall amount you have to pay on taxes.

Without professional, on-going, forward-looking support, you can end up paying more taxes than you legally need too.

One great way that a CPA sets you up for success in this regard is to forecast cash-flow and determine estimated taxes to pay, deferred retirement options and personal wealth growth.

Speaking of strategy, strategic planning is the highest leverage benefit that a CPA will bring to your business at this phase of your business’ growth.

“In this third stage of the e-commerce lifecycle, the attempts to reinvigorate your company’s momentum and growth should always be strategic.”

This is an area that CPAs are experts in, and you want a CPA who knows your eCommerce business.

Depending on what your strategy is, or what direction your business is moving in, your CPA will make both short- and long-term predictions about your eCommerce future.

He or she will also provide advice specific to the Phase your business is in now, as well as the Phase(s) you want to reach. CPAs can also provide you with a general managerial accounting background, plus access to quantitative data that you need in order to make well-informed business decisions. This may include, but is not limited to setting profitability goals, creating acquisition strategies, and developing risk management processes.

As your business grows and you begin to move into Phase 4, a qualified and professional CPA team of experts will provide you with insight and wisdom that will be invaluable to your company’s goals. Statista predicted that retail eCommerce sales will hit $4.2 trillion in 2020, up from $3.5 trillion in 2019.

If your goal is to continue growing your e-commerce business into Phase 4, then you’re probably already looking for advisory and strategy help.

The right CPA firm is an invaluable expert to have on your advisory team that can help advise, coach and strategize with you, helping reach your goals.

For sellers with profits of $1 million+.